Daily Cash Register Balance Sheet

DAILY CASH REGISTER BALANCE SHEET

INTRODUCTION

The daily cash register balance sheet is an apt way of analyzing your company’s performance. You can easily calculate the company’s financial position using the regular cash register balance sheet. You do this by putting your daily cash entries into the register balance sheet, then subtract the liabilities from the assets to get the net worth of the organization. This formula applies to all types of balance sheets. Balance sheets allow you to compare your company’s financial situation with other competing companies.

You can use balance sheets to analyze the company’s financial position for a specified amount of time, such as daily, monthly, annually, after a decade, among others. In this guide, we take a review of the daily cash register balance sheets you can use, the features tips, among other related issues.

Let’s begin,

How to use the daily cash register balance sheet template

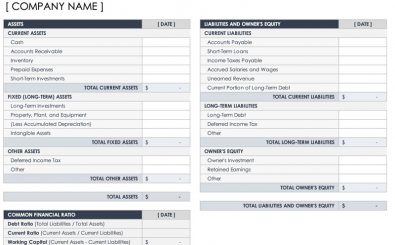

The daily cash register balance sheet excel can be simple or detailed. The simple balance sheet is easy to use because you make primary data entries on assets and liabilities. The detailed one shows taxable income, capital gains, expenses, property costs, among others.

It is easy for a typical cashier to use the balance sheet because it automatically shows the net worth of the company. The daily entries of transactions should be correct for you to get accurate figures for analysis. The net worth calculated allows you to compare the financial state of your company to other competing companies.

Features

The daily cash register balance sheet excel shows the company’s name, current assets, long-term assets, fixed assets, the profits, among others. It analyzes your company’s value, allowing you to plan, make comparisons with competitors, define the company’s goals, and others. You can also do timely analysis daily, annually, monthly, among others.

Tips

You can download the daily cash register balance sheet templates for free online. You can also find them on accounting softwares such as Quickbooks, GNU cash, among others.

The balance sheet cannot automatically autocorrect, so you need to key in data correctly to avoid time wastage when counter checking entries.

Some standard balance sheets include:

Basic balance sheet

It is easy to use due to its simple format. You can comfortably key in financial data to complete it and get the analysis of the company’s net worth. You can break down the outcome you get then represent it in other forms such as bar graphs, charts, among others. The balance sheet will allow you to make comparisons and determine the ultimate value of the firm. The information you get from the balance sheet can be timely- specific such as daily, weekly, monthly, annually,e.t.c.

Business-oriented balance sheet excel

Examples include:

Small business balance sheet

It is ideal for small businesses in a way that data can easily be retrieved and analyzed for quick planning of the small firm. The columns are for entries of financial data for different years. The information has a strategic arrangement to enable you to trace the overall annual performance of the firm every fiscal year. It shows tallies of your net worth and the working capital as well.

Non-profit balance sheet

It is ideal for non- profit-making companies and start-up businesses. It gives information about the company’s liabilities, annual assets, equity, among other project-related finances. It allows an easy comparison of the company’s asset value over the years. You can customize it by putting your company’s logo, terms, and conditions, among other policies. They can be saved on your drive as google sheets or excel as personal data, to make other financial or organizational plans.

Real estate balance sheet

The real estate balance sheet is property specific, showing the asset value of each property based on its investment project. It also shows the potential for property investment in making profits. It shows information related to real estates such as insurance, furnishings, valuables, and others. It gives you a precise analysis of the state of your property if it’s appreciating or depreciating over the years. You can key in data such as assets, liabilities, and equity on this balance sheet.

Investment property balance sheet

It is a detailed template that shows investment properties with their actual financial blueprints. They include property costs, taxable income, expenses, capital gains, selling costs, and rent taxations. This comprehensive balance sheet allows you to calculate your property’s increase in value over time. It enables you to include details that show the growth of your property.

Trucking company balance sheet

This balance sheet template allows you to counter check your entries daily, monthly, or annually. It helps you to analyze the value of your truck if it is increasing or decreasing. It shows the financial cost of each vehicle, and it’s potential to bring in returns for the company. It is easy to use and ensures accurate record keeping.

Restaurant balance sheet

It is easy to use and applies to all food and beverage companies such as fast food, bar, and grill, fine dining, among others. The information on this template is restaurant-specific, which makes it easy to use. It shows the profitability of the company in a way that you can earn daily, monthly, or yearly financial comparisons.

Calendar-specific balance sheet excel

They include:

Daily balance sheet

The daily cash balance sheet template helps you to key in day-to-day records showing assets, liabilities, and equity. The totals will display automatically, allowing you to calculate the value of the firm. You can save the information for future analysis such as yearly deductions, comparisons, among others.

Quarterly / monthly balance sheet

It is for the short-term analysis of the financial position of your firm. The columns can also reflect three- month figures for each quarter. You can key in information about assets and liabilities to calculate the net worth of the firm.

Year- to- date balance sheet

It helps you to compare the financial performance of the company for the previous years up to date. The data on assets and liabilities should be set clearly on the year of collection for easy comparison. The columns allow you to arrange the work strategically so that you can easily make deductions at a quick glimpse.

Yearly balance sheet

This balance sheet template allows you to see the bigger picture of the organization’s profitability. It will enable you to make necessary data comparisons of the previous years and make resolutions on how to increase your profits. It also allows you to compare the assets and liabilities of the subsequent years to enable you to rate the overall performance of the company.

The daily cash register balance sheet template is available for you online. You can download or simply click on the excel templates website for more information.