Tax Deduction

Tax Deduction Template

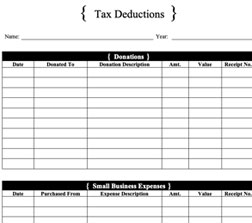

The Tax Deduction Template is specially designed to provide you with an easier solution to your yearly deduction’s calculator. It can be extremely difficult to keep track of all the standard yearly deductions you have, and the itemized deductions throughout the year. Keep track of your itemized deductions using our calculator will help you immensely when pesky tax season comes around. This template is created in excel and is customizable to your home, business, or brand. The types of deductions vary from standard to itemized, and again you can make this template work for you.

How To Use

When using the template keep in mind that you will have the option between the standard deductions model and the itemized deductions model. When speaking about the the standard deduction you will use a fixed dollar amount which will then be deducted from your income salary. When speaking about the itemized deductions model, you will find the option for certain amounts of deductions to be claimed.

Should there be any overall confusion regarding how to use the standard or itemized options on the excel tax deduction template. Keep these points in mind as you begin to customize your own tax deduction template.

The total amount of the sum of all your itemized deductions need to be higher than the standard deduction total sum. When doing this, documentation is necessary in order to prove that your statements about your finances are indeed correct and factually based. You will want to avoid any mishaps with the IRS and should always maintain your records during tax season.

When looking at the template you will check the top of the page to read which relevant headings will make sense to start with according to your business, home, etc.

Included in this template or Features

Included in this excel tax deduction template you will receive an itemized deductions calculator that comes with two sections known as the header section and the calculation section. These areas are where you will fill out your personal financial details that correspond to each category.

Optional Tips

1. Use the checklist provided for ideas on what tax deductions would make sense for you. Simply read the different titles to which one is going to make the most sense for yourself. If you find you do not need certain categories, feel free to remove them or change them into something else that works better for your home or business taxes.

2. Use the tables by clicking inside each cell and typing up the financial information you need to keep track of. Ensuring that you do this routinely so you do not lose anything throughout the year. This keeps you organized and if you are able to scan in receipts or any documentation that makes sense to show to the IRS, this is the time to do it. It is best practice when doing tax deductions that every two weeks or at the maximum, every month, you sit down to fill out your template with the most up to date information for your business or home taxes.

3. Use the template calculation features to make your life that much easier when it comes to doing your taxes. The codes set up in this excel spreadsheet are there to automatically add up or subtract relevant information. You are able to sit back and relax fully knowing that you will not have a long list of calculations to do on your own which can be susceptible to mistakes. With the built in calculation codes, you can feel more at ease knowing that the overall amounts will be summed up correctly.

The difference between Standard Deductions vs Itemizing

The general rule is to add up your itemized deductions and compare them against your standard deductions. Choose whichever one is greater is likely the one you should go with. The reason people steer away from itemized deductions is typically because it might not differ too greatly from the standard deductions. Which overall means that taking the extra effort to type up and calculate using your itemized tax deduction template could be a waste of time.

However, you should know the difference when it is time to make that extra effort because it could save you a lot of time in the long run. For example, compare the standard deductions which on average are about $12,000 in you’re single, and $24,000 if you are filing as married. Keeping track of your itemized tax deduction template could be the difference at the end of the year where you end up with a much higher deduction than your standard amount. It is well worth the effort to keep this going just to see what you end up with after your first year using a template.

With your itemized list you might want to consider the following categories that are known to be used by tax professionals.

The first topic to consider is medical, this is going to be for all your out of pocket medical expenses like eye, dental, and even chiropractic therapy.

Secondly, consider if you are eligible to deduct your mortgage but more specifically your primary home acquisition indebtedness. This does not apply to your second home or your vacation home, only your primary home. However, this is certainly worth looking into.

Thirdly, charitable donations are going to be something you keep track of. So many people donate clothing, cars, money, and more throughout the year and it is worth noting this information down on your template.

Lastly, you will want to keep in mind that you can no longer write off the cost of using a tax specialist in 2020. Which is why these incredible templates are worth your while and help you categorize your life and make it so much easier for you to understand what is going on with your finances at the end of each year. With the high prices of tax professionals, sometimes doing it yourself is the best option!

DOWNLOAD