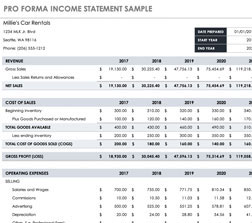

Pro Forma Financial Statement Template

Pro Forma Financial Statement Template in Excel

What are pro forma financial statements?

Pro forma statements are monetary reports detailing how your business would fare based on hypothetical situations. In other words, they help you make accurate predictions about what will happen to your company in the future. That kind of insight is great for making plans or raising funds from banks or private investors.

Pro forma statements come in three typical formats:

Pro forma documents can resemble normal statements, but they’re purely based on hypothetical questions. For example, you might ask yourself “What should I do if my company receives a $100,000 loan in a year?” A pro forma statement contemplating this question would reflect this loan in the sections for profit, balance, and level of cash flow.

Why Bother With Pro Forma Financials?

Thinking about where your business will be in the future can be a big help. Pro forma financial statements in Excel can help you figure out how to finance your business or impress lenders with your adaptive business model.

Imagine how things will change when your company starts bringing in more money. Important variables such as how much you need to pay in taxes could change multiple times. It makes sense to start planning how to combat that change as early as possible. This sort of forward thinking is what goes into a financial forecast.

Pro Forma Financial Statements vs. Budgets

Don’t trick yourself into thinking that a pro forma statement is equal to an actual budget. It can be tempting to do so because both concepts revolve around how your business is going to spend its money in the future. In fact, the budget you have now can easily play a role in a pro forma statement! But the difference between the two platforms outweigh their similarities.

Pro forma statements are entirely based on predictions – but budgets are more solid plans, incorporating your current financial status instead of revolving around possible windfalls later on down the road.

Take a look at this hypothetical for better understanding: Imagine you’ve made $40,000 this year. Based on your pro forma income statement, next year’s income will reach $48,000. When you’re drafting the budget for the next year, you can add in the additional $8,000 – but how? Will you pay off loans? Reinvest in the company? There are a million different things you can do with the money, and every decision has positive and negative impacts. Thinking it through for an extended period of time is your best bet to make a good decision.

Versions Of Pro Forma Financial statement templates in Excel

These categories all fall under the formats described above, but still possess unique characteristics.

1. Year-Long Pro Forma Forecast

This projection accounts for your annual financial position up through the current moment, and includes extrapolated outcomes for the rest of the year. This method gives those involved, whether they work for the business or are thinking about putting up money for it, an idea of what kind of shape the business might be in as the year comes to a close.

2. Financial Pro Forma Forecast

This type of pro forma projection revolves around how your business gets its funding. If you’re trying to woo investors or talk your colleagues into agreeing that the business needs to be financed, your best bet may be to use a financial pro forma projection. It covers infusions of money from external sources, as well as any interest you need to pay and how these circumstances impact the business.

3. Historically Acquired Pro Forma Forecast

The third projection on this list, takes a look at two things: the history of your business’s financial statements, and the same for a different business that you’d like to buy. Those two histories are combined together, and the result provides insight as to how your finances would look if you had acquired the other business earlier in time. This model will help you figure out what would happen if you made such a purchase now.

4. Risk Analysis Pro Forma Forecast

It’s a good idea to consider positive and negative possibilities for your business so that you can be more prepared for them in the future. What will you do if one of your consistent vendors suddenly increases their prices? Can you compensate for it without tanking? You can compare your current accounts paying in this excel template with possible future price increases. We know, thinking about risks like these isn’t always fun, but it’s best to be able to answer tough questions like these.

Pro forma templates are convenient because you can operate one by using a normal monetary statement template (such as those found on exceltemplates.net) and applying hypothetical questions to it.

DOWNLOAD