Multi Step Income Statement Template

Multi Step Income Statement Template

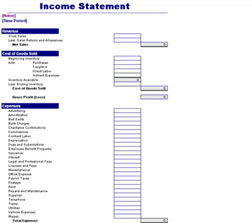

A multi step income statement is a statement that shows income, expenditures, profits, and losses; and divides them into two separate categories: Operating items and Non-operating items. A multi step income statement allows for users to quickly and easily locate a specific item, as well as allow for business owners to better see how their business operates and make any appropriate adjustments. Additionally, an accounting multi step income statement is useful for companies that have unique situations or need to be able to deduct multiple subtractions

Within an accounting multi step income statement there are three sections, the Operating head is the first section. This section contains the gross profit of business, which is found by subtracting the cost of goods sold from the total sales for a specific time frame. The second section of a multi step income statement template is where selling and administrative expenses are recorded. The third, and final section is the Non-operating head. This section contains a list of all expenses and incomes related that are not related to a business’s principal activities. Together these three sections are used to find a company’s net income for a specific time period.

Multi-Step Income Statement Formulas

Three formulas are used to calculate net income.

- Gross Profit = Net Sales – Cost of Goods Sold

- This formula calculates your gross profit on your multi-step income statement.

- Operating Income = Gross Profit – Operating Expense

- This formula calculates your operating income on your multi-step income satement

- Net Income = Operating Income + Non-Operating Items

- This formula calculates your net income on your multi-step income statement.

Why use a Multi-step income statement?

Most small businesses use a Single-step income statement template. Mostly, larger more complex businesses will use a multi-step income statement to run more detailed finacial reports. We think it is good practice to be more detailed in your business operations and expenses from the start. This helps you understand your business in more detail to find where you could be losing profits or help you ideate on how you can cut costs.

You don’t have to be a large cooperation to use a multi-step income statement. In fact this is why we made a ready to use excel template so you can plug your data into this multi-step income statement and start running your small business like a large business.

How to use a multi step income statement

Using a multi step income statement template is incredibly easy.

1. To start select your reporting period. Monthly, Quarterly, and Annually. Most private businesses will prepare their multi-step income statement Annually. While public companies are required by law to prepare their income statements Quarterly and Annually. For a small busienss it is wise to track your income monthly. This will help you understand how your profits are changing over time to keep you finger on the pulse of your company.

2. Fill in the name of your company, title the document and store it in a folder that is easy to remember and access so you can quickly refrence and update your multi-step income statement.

3. To start the total cost of goods sold is deducted from the net sales to achieve the gross profit. This gross profit margin shows how profitable a business is, and is an invaluable amount for potential investors and management to review.

4. Next, all operating expenses including any administrative and selling expenses are totaled to achieve the total operating expenses. The total operating expenses are then subtracted from the gross profit to find the total operating income.

5. The Non-operating items is the last section which includes any incomes or expenses not related to the business’s sales or operations. Once the total of these items is found, depending on whether it is a positive or negative figure, the total Non-operating items is either added to or subtracted from the operating income to find the company’s net income.

Features

The multi step income statement template excel spreadsheet is an easy tool to set up and utilize. The excel spreadsheet is as easy as plugging in the appropriate amounts into the accurate location. Firstly, the template is separated into the three aforementioned sections: Operating, Operating expenses, and Non-operating. There is of course a specific location for items like cost of goods sold, net sales, and non-operating related items. Additionally, areas like administrative and selling costs are expanded to provide specific headings to match common subcategories of expenses within these two topics. This allows businesses to have a comprehensive view of all non-operating expenses that occur as a result of doing business. Excel’s number crunching ability will generate the totals for the gross profit, total operating income, and ultimately the company’s overall net income. The multi step income statement template excel spreadsheet creates a convenient and easy to understand tool that can be incredibly beneficial for business owners looking to examine how effectively their business is operating as well as be an invaluable resource to provide to potential investors.

Optional Tips for using a multi step income statement.

Have numbers for each category (cost of goods sold, net sales, administrative expenses, etc.) pre-calculated to make input even easier.

Make sure to include unusual or unique non-operating items like: a return on investments, settlements, losses and gains related to interest, just to name a few.

Make sure to remember to include all expenses including salaries, rent, utilities, supplies, advertising costs, and freight expenses, so all numbers are accurate and provide a true look at the costs of running a business.

A multi step income statement can be highly beneficial for a number of reasons. It can help business owners who are looking to manage the expenses that occur, it can be a comprehensive tool needed for businesses that have unique expenses and incomes not related to business operations, and provides them with the spaces to do so. Additionally, because it clearly displays a company’s gross profit margin, a multi step income statement is the perfect document to provide investors with so they are immediately able to see how monetarily successful a business is. Because a multi step income statement is so detailed, it is important that it is prepared properly so that profit margins are accurate and not adjusted to appear more successful. To combat this, it is highly recommended that multi step income statements are generated frequently to maintain accuracy as well as give insight into a company’s income and expenditure related trends. Overall, it is considered that a multi step income statement can be beneficial for almost every type of business, as it is an incredibly detailed tool that can help businesses operate optimally, and create sustainable growth over time.

DOWNLOAD