Monthly Income Statement Template

Monthly Income Statement Template

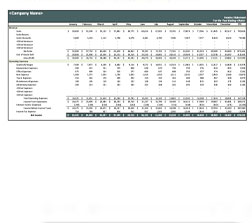

A monthly income statement can be an invaluable tool for business owners. It provides a simplified look at the profitability of a business, and can help show where financial opportunities are. A monthly income statement, also called a profit and loss statement, summarizes the financial operations of the month as well as provides an in-depth look into the financial health of a business. Additionally, a monthly income statement can be an item that many investors or lenders require before they are willing to provide any financial backing, as they need to make sure a business is maintaining healthy financial habits and is not a risky venture. A monthly income statement provides the bottom line for a business, which is the net income or net loss for the month. A monthly income statement includes sections for revenues/income, cost of goods sold, gross profit, expenses, taxes, and net income or net loss.

Alternatively, a personal monthly income statement can be generated as well, however there are certain adjustments that must be made. Things like cost of goods sold are obviously omitted from a personal monthly income statement template excel spreadsheet, but it can still provide an important look into where personal monies have gone within a month. Also, using a personal monthly income statement template excel spreadsheet can make budget creation simple and quick as it already provides insight into what expenses already exist and how much money is being spent in various categories. Additionally it can be a useful, comprehensive document to provide when seeking a loan or credit.

How to use a monthly income statement template.

Because a monthly income statement template shows profitability, it is important that these statements are being generated on a regular basis, this is why utilizing a monthly income statement spreadsheet can be incredibly helpful for providing an at-a-glance look at multiple months and even the full year’s figures. Additionally, it can be incredibly valuable to note the monthly income statement before and after an event that can potentially change the finances of a business, like the release of a new product or service. A monthly income statement can also be useful when filing taxes, as it tracks taxes paid as well as the amount of income that will be claimed and does so all in one place.

Features of a monthly income statement spreadsheet.

- Revenues/income: This is a record of the amount of money received through sales or providing services. Any returns or sales discounts are subtracted from the total revenue earned.

- Cost of goods sold: This includes any production, supply, or labor expenses related to cost of creating goods or providing services.

- Gross profit: This amount is found by subtracting the cost of goods sold from the total revenue.

- Amortization: is the process of allocating the cost of an asset over multiple. You do so by using a amortization schedule is a table used to show each additional payment in a loan or bond, in order to calculate the remaining principal balance in each subsequent period until maturity.

- Depreciation is a non-cash expense which represents the wear and tear of an asset over time. When you calculate depreciation, you determine the value of the asset at a future point in time by using a fractional calculation which allocates a portion of the asset’s cost to each year of its useful life.

- Expenses: This includes all expenses that are generated through business operations. This includes salaries, supplies, rent, and any professional or administrative fees.

- Operating Income (EBIT): is defined as net income from ongoing operations before accounting for interest payments and taxes.

- Taxes: This is a place to record the tax liability of a business. This figure is related directly to the amount of money generated through sales.

- Net income/net loss: This final figure determines the profitability of a business. Using the net income or net loss can greatly aid with budget creation, and can help business owners see exactly where improvements can be made in the overall business operations.

Monthly Income Statement Tips

- Make sure all expenditures are accurate to ensure final figures are correct. Expenses should also be documented in the appropriate categories so that budget creation is simpler.

- It can be helpful to schedule a time each month to fill out the monthly income statement. This ensures that a month is never missed and allows for any discrepancies or issues to be adjusted or repaired.

- Make sure that often overlooked expenditures like depreciation are being accounted for.

Preparing a monthly income statement can help businesses track expenditures, profits, and maintain financial health for a long period. Additionally, a monthly income statement can help businesses that are losing money to see exactly where their money is going, where spending can be adjusted, and ultimately create a budget that can be used successfully. And, by using a blank monthly income statement template the creation of the statement is incredibly easy, all a business owner needs to do is assemble financial records and plug each amount into the appropriate category. Once this is done, excel does all the mathematical work, providing totals for profits and expenditures, and ultimately generating the net income or net loss amount. Properly preparing and using a monthly income statement can make all the difference for businesses, both newer companies and those established, it can help businesses track growth, it can assist with budget creation and loan applications, and it can also assist companies to grow more successful and profitable.

DOWNLOAD