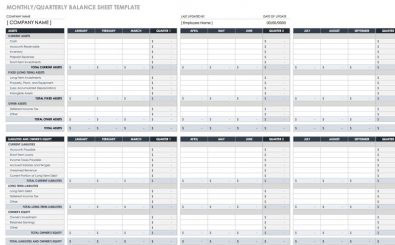

Monthly Balance Sheet Template

A Monthly Balance Spreadsheet Article

A large extent of different businesses and companies including many small businesses and related nonprofit organisations utilize a monthly balance sheet template as a business financial statement to maintain history on their business’s assets, liabilities, and regular equity on a specific point over a certain extent of time. There are several different modern tools today that can help you complete these specific checkups, but nothing seems to be as simple as having and maintaining a professional monthly balance sheet template.

Small Business Monthly Balance Sheet Template

Spreadsheet

This type of business spreadsheet is a monthly balance sheet template spreadsheet that is created for your pre-existing small businesses, or also with conceived data for your small business system. Yearly business columns offer continual, annual comparisons of business fixed assets along with both current short term and long-term liabilities in order for you to quickly see your business’s own equity. This professional business balance sheet template can include various tallies of your net assets too.

A Basic Monthly Balance Sheet Template Excel

A business Excel Balance Sheet template is a special template designed with formulas and systems in order to correctly calculate different totals for client-supplied figures. You can use this easy, monthly balance sheet template excel to correctly see your complete financial predicaments. You will be able to fill out your information about your long-term business assets, long-term business liabilities, as well as view your current business net worth. You will be able to also fill out predicted figures in order to view your financial position as well as to view just how near you are to completing your professional financial goals.

A Non-Profit Balance Sheet Template

A professional non-profit balance sheet template is a really great template for first time startup non-profit companies and businesses. These templates include the benefits of entering and completing yearly or projected business assets, business liabilities, and also general equity for annual comparisons of the company’s overall financial health. You can also customize the non-profit business template by simply adding your company’s own personalized symbol and any also any related terms and conditions. This cool template is available in excel in order to save as individual yearly templates, as well as business Google Sheet templates that can quickly be saved right to your professional Google Drive account.

A Real Estate Balance Sheet Template

A Real Estate Balance Sheet template is a smart balance sheet used to enter all data specific to a particular property. This includes business liabilities, business property assets, and overall equity in order for you to simply view just how profitable your actual property is. This easy business template is also special in its incorporation of general insurance information as well as other real-estate-related data like that of furnishings and valuables, while giving you a powerful and authentic image of your own property to appreciate for years to come.

What Are Some Elements of a Professional Monthly Balance Sheet?

Some of the elements of a proper and correct monthly balance sheet are things like your company name. Your actual business name is one of the most vital things to be seen in your business balance sheet and gives you a wise sense of identification for your file. The different auditors who will eventually swoon over your official financial statements can also be able to clearly confirm that your monthly business balance sheet they are viewing and going over is actually from your business organization. Another wise element of a correct monthly balance sheet is the correct time period. A business balance sheet is specifically designed to correctly show a business’s financial assets and their business liabilities on a specific point over a certain interval of time. In a business balance sheet, you will be viewing your business’s financial position that is gone over in a month.

Assets, assets, and more assets. Your actual business assets in a business balance sheet constitute every piece of the products as well as business resources that your organisation owns. General sections of business assets are things like money. Business stocks, supplies and also prepaid purchases. The complete total of your business’s assets should be balanced out with your business’s own liabilities as well as owner’s equity. What about liabilities?

The various different liabilities that are in your balance sheet actually account for each one of the actual debts that have collected up just until the current month. They can be both long-term and short-term debts. Just as long as they are debts that are actually due for pay from your business. Business liabilities on the other hand, can be seen as mortgages, accounts payable, and even pension plan agreements. Last but not least, equity. The owner’s personal equity found in your own balance sheet will constitute the specific amount of cash invested to the business. This is from the owner’s finances that are put into certain investors that are funding support. In the end, the total amount of both the liabilities as well as the equity should more than likely equal out with the business’s assets.